การเปรียบเทียบตัวแบบการพยากรณ์ราคาหุ้นโดยใช้ตัวแบบอารีมาและจีวีเอ็ม

คำสำคัญ:

ตัวแบบอารีมา, ตัวแบบเกรย์, ตัวแบบเกรย์เวอร์เฮ้าท์, ร้อยละของค่าความคลาดเคลื่อนสัมบูรณ์ค่าเฉลี่ยบทคัดย่อ

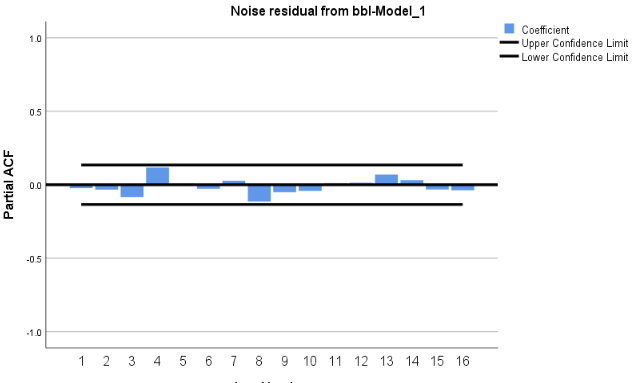

การศึกษาครั้งนี้มีวัตถุประสงค์เพื่อสร้างตัวแบบพยากรณ์ราคาหุ้น โดยศึกษาตัวแบบอารีมาและตัวแบบเกรย์ ภายใต้ตัวแบบ GM(1,1) และตัวแบบเกรย์เวอร์เฮ้าท์ (Grey Verhulst Model: GVM) สำหรับข้อมูลราคาหุ้น BBL รายวัน ตั้งแต่เดือนกรกฎาคม 2565 ถึงเดือนมิถุนายน 2566 จำนวน 240 วัน ผู้วิจัยได้แบ่งข้อมูลออกเป็น 2 ชุด ชุดที่ 1 ตั้งแต่เดือนกรกฎาคม 2565 ถึงเดือนพฤษภาคม 2566 จำนวน 222 วัน สำหรับการสร้างตัวแบบพยากรณ์ด้วยวิธีการทางสถิติทั้งหมด 3 วิธี ได้แก่ ตัวแบบอารีมา และตัวแบบเกรย์ภายใต้ตัวแบบ GM(1,1) และตัวแบบเกรย์เวอร์เฮ้าท์ ข้อมูลชุดที่ 2 เดือนมิถุนายน 2566 จำนวน 18 วัน นำมาใช้สำหรับการเปรียบเทียบความแม่นยำของตัวแบบพยากรณ์ด้วยเกณฑ์ร้อยละค่าความคลาดเคลื่อนสัมบูรณ์เฉลี่ย และเกณฑ์รากที่สองของความคลาดเคลื่อนกำลังสองเฉลี่ย (RMSE) ที่ต่ำที่สุด ผลการศึกษาพบว่า ตัวแบบที่มีความแม่นยำมากที่สุด คือ ตัวแบบ GM(1,1) มีความผิดพลาดในจากการพยากรณ์ร้อยละ 0.724 (MAPE = 0.724) หรือมีความผิดพลาดจากการพยากรณ์ 1.463 (RMSE = 1.463) ซึ่งทั้ง 2 เกณฑ์ที่ใช้ในการเปรียบเทียบความถูกต้องของตัวแบบพยากรณ์ให้ผลเป็นไปในทิศทางเดียวกัน จึงทำให้มีความน่าเชื่อถือได้มากยิ่งขึ้นว่าตัวแบบ GM(1,1) เป็นวิธีที่มีความเหมาะสมกับอนุกรมเวลาชุดนี้มากที่สุด

เอกสารอ้างอิง

Kayacan, E., Ulutas, B., & Kaynak, O. (2010). Grey system theory-based models in time series prediction.Expert systems with applications,37(2), 1784-1789.

Shen, C., Du, F., Zhang, L., & Song, H. (2019, February). Application of GM (1, N) model in groundwater mineralization in Cheng’an County. InIOP Conference Series: Earth and Environmental Science, 233(4), 042010. IOP Publishing.

Puripat, C., & Sarikavanij, S. (2018). The comparison of Grey system and the Verhulst model for rainfall and water in Dam prediction.Advances in Meteorology,2018.

Davis, P. D., Amankwah, G., & Fang, Q. (2019). Predicting the rainfall of ghana using the grey prediction model GM (1, 1) and the Grey verhulst model.International Research Journal of Engineering and Technology (IRJET),6(8), 1362-1372.

He, F., & Tao, T. (2014). An Improved Coupling Model of Grey-System and Multivariate Linear Regression for Water Consumption Forecasting.Polish Journal of Environmental Studies,23(4).

Amphanthong, P., & Busababodhin, P. (2015). Forecasting PM10 in the upper northern area of Thailand with grey system theory.Burapha Science Journal,20(1), 15-24.

Doungdee, N., & Chiangpradit, M. (2018). Forecasting Crisis Peaks of Economics in Thailand Using Grey Model.Burapha Science Journal, 1111-1122.

Liu, S., & Forrest, J. Y. L. (2010).Grey systems: theory and applications. Springer Science & Business Media.

ดาวน์โหลด

เผยแพร่แล้ว

ฉบับ

ประเภทบทความ

หมวดหมู่

สัญญาอนุญาต

ลิขสิทธิ์ (c) 2023 Journal of Applied Science and Emerging Technology

อนุญาตภายใต้เงื่อนไข Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.