An analysis of the effectiveness of the government policy program for assisting farmers in non-performing loan from participation in the moratorium project on rice in the year 2016/17

Keywords:

An analysis of farmers' repayment behaviors, NPLs management, the effectiveness of government policy programAbstract

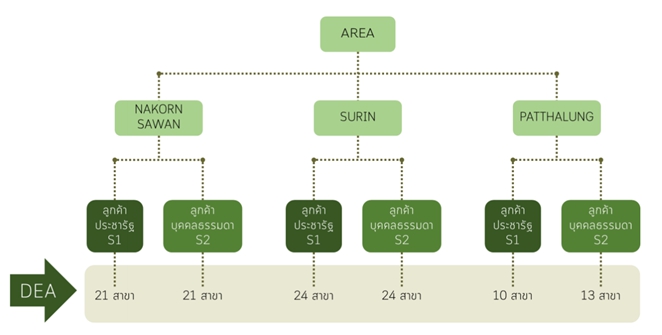

The purpose of this study was to study the effectiveness of the government policy program for assisting farmers in NPLs’ debt from participation in the rice moratorium project 2016/17. The data was analyzed by descriptive statistics which it was found that the rice moratorium project 2016/17 was unable to help farmers enough, some of whom changed from being the status of normal debt to the status of NPLs’ debt. Thus it causes the bank to incur expenses in managing debts which did not generate income. This research studied on factors causing NPLs’ debt by analyzing famers’ behaviors from participation in the project, divided into 3 areas, namely the cumulative interest payments, the principal remaining payments, the change of the status of NPLs’debt from Nakhon Sawan, Surin, and Phatthalung provinces were a total of 118,508 people.

The results revealed at the end of the moratorium project on rice in the year 2016/17, the number of all farmers who are the status of NPLs’debt is reduced by 22.84 percent. Six farmers have changed from being the status of normal debt to the status of NPLs’ debt due to the change of the moratorium project on rice in the year 2016/17. The principal remaining payments decreased by 36.88 percent and the cumulative interest payments increased by 42.59 percent. In conclusion, the farmers who are NPLs’ debt from the beginning to the end of participation in the program have still not repaid their debts or defaulted on their repayments. The factors affect repayments such as farmers’ behaviors and the external impacts: transferring or changing of the project during management and the project ending. In addition, the resutls of grouping famers'behaviors show that the moratorium project on the principal remaining payments and the reduction of interest rates for the formers in the year 2016/2017 are effective and appropriate for some groups of farmers able to repay the interest at the end of the project with the low loan (not over 500,000 baht)

Downloads

Published

Issue

Section

License

Copyright (c) 2021 The Journal of Applied Science

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.