Enhancing FOREX Market Predictions: A Comparative Study of Candlestick Patterns and the MIDDAM Patterns

Main Article Content

Abstract

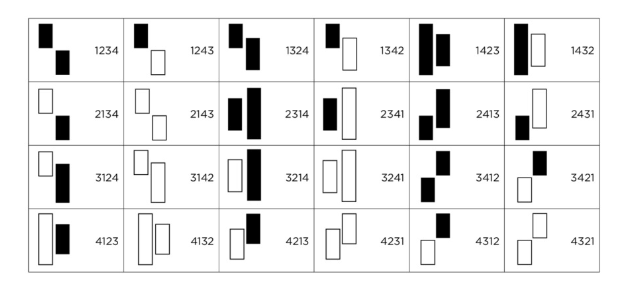

Candlestick patterns are widely recognized as tools for predicting price movements, gaining popularity in the stock market. However, their applicability in the FOREX market, which operates continuously 24 hours daily, remains uncertain. This study assesses the accuracy of widely known candlestick patterns, particularly Doji patterns, in the FOREX market. We analyze the top eight most-traded currency pairsEUR/USD, EUR/GBP, GBP/USD, GBP/JPY, USD/JPY, USD/CHF, AUD/USD, and XAU/USDusing 13 years of data. The findings reveal that Doji patterns are unreliable indicators of reversals in the FOREX market. Instead, this research introduces a new candlestick pattern, MInimal Dierence in shadow for Directional Analytical Movement (MIDDAM), which is designed for both uptrends and downtrends and significantly improves predictive accuracy. Extensive experiments demonstrate that the proposed patterns outperform traditional ones in protability and trade success. By comparing the effectiveness of these patterns in real market simulations involving over 38 million 1-minute historical candles, MIDDAM patterns yield 138 times more protable than Doji patterns, achieving a win-to-loss ratio of 6:2 across the tested currency pairs. This study underscores the potential of MIDDAM patterns for more reliable predictions and superior trading performance in the FOREX market.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

References

A. S. Alanazi and A. S. Alanazi, “The Profitability of Technical Analysis: Evidence from the Piercing Line and Dark Cloud Cover Patterns in the FOREX Market,” Cogent Economics & Finance, vol. 8, no. 1, 2020. 133

G. Caginalp and H. Laurent, “The predictive power of price patterns,” Applied Mathematical Finance, vol. 5, no. 3, pp. 181–205, 1998.

G. Cohen, “Best Candlesticks Pattern to Trade Stocks,” International Journal of Economics and Financial Issues, vol. 10, no. 2, pp. 256–261, 2020.

E. Cortez, Doji Candlestick Pattern: A Simple Candlestick Trading Strategy for Consistent Profits, Zantrio Trading, LLC, 2014.

S. Deng, Z. Su, Y. Ren, H. Yu, Z. Zhu and C. Wei, “Can Japanese Candlestick Patterns be Profitable on the Component Stocks of the SSE50 Index?,” SAGE Open, vol. 12, no. 3, 2022.

H. A. do Prado, E. Ferneda, L. C. R. Morais, A. J. B. Luiz and E. Matsura, “On the Effectiveness of Candlestick Chart Analysis for the Brazilian Stock Market,” Procedia Computer Science, vol. 22, pp. 1136–1145, 2013.

M. Jamaloodeen, A. Heinz and L. Pollacia, “A Statistical Analysis of the Predictive Power of Japanese Candlesticks,” Journal of International & Interdisciplinary Business Research, vol. 5, no. 5, 2018.

T. Lu and J. Chen, “Candlestick charting in European stock markets,” The Journal of the Securities Institute of Australia, vol. 2, pp. 20-25, 2013.

B. Lucke, “Are Technical Trading Rules Profitable? Evidence for Head-and-shoulder Rules,” Applied Economics, vol. 35, no. 1, pp. 33–40, 2003.

B. R. Marshall, M. R. Young and R. Cahan, “Are Candlestick Technical Trading Strategies Profitable in the Japanese Equity Market?,” Review of Quantitative Finance and Accounting, vol. 31, pp. 191–207, 2008.

A. Noertjahyana, A. Noertjahyana, Z. A. Abas and Z. I. M. Yusoh, “Combination of Candlestick Pattern and Stochastic to Detect Trend Reversal in Forex Market,” 2019 4th Technology Innovation Management and Engineering Science International Conference (TIMES-iCON), Bangkok, Thailand, pp. 1-4, 2019.

I. Orqu´ın-Serrano, “Predictive Power of Adaptive Candlestick Patterns in FOREX Market. Eurusd Case,” Mathematics, vol. 8, no. 5, p. 802, 2020.

S. Sangsawad and C. C. Fung, “Extracting Significant Features Based on Candlestick Patterns Using Unsupervised Approach,” 2017 2nd International Conference on Information Technology (INCIT), Nakhonpathom, Thailand, pp. 1-5, 2017.

S. Thammakesorn and O. Sornil, “Generating Trading Strategies Based on Candlestick Chart Pattern Characteristics,” Journal of Physics: Conference Series, vol. 1195, 2019.

Y. Udagawa, “Mining Stock Price Changes for Profitable Trade Using Candlestick Chart Patterns,” in Proceedings of the 21st International Conference on Information Integration and Web-based Applications & Services, pp. 118-126, 2019.

S. B. Yassini, F. R. Roodposhti and M. F. Fallahshams, “Analyzing the Effectiveness of Candlestick Technical Trading Strategies in Foreign Exchange Market,” The International Journal of Finance and Managerial Accounting, vol. 4, no. 15, pp. 25–41, 2019.