Comparative Study on Stock Movement Prediction Using Hybrid Deep Learning Model

Main Article Content

Abstract

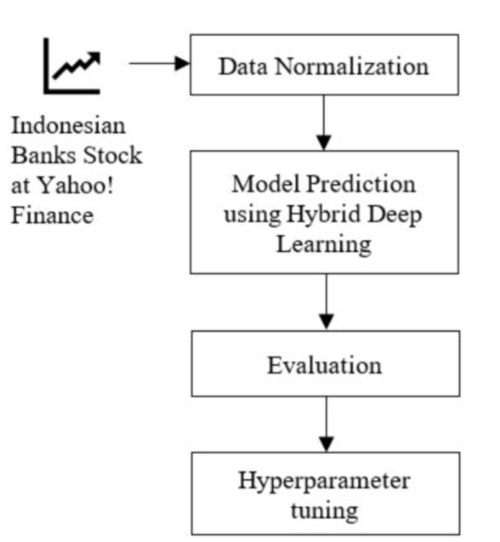

Applying machine learning techniques in stock market prediction has evolved significantly, with deep learning methodologies gaining prominence. Conventional algorithms such as Linear Regression and Neural Networks initially dominated but struggled to capture complex temporal dependencies in financial data. Recent research has explored deep learning architectures like LSTM and CNN and hybrids such as CNN-LSTM and LSTM-CNN, showcasing promising results. However, there's a gap in research comparing these models across different datasets, particularly in predicting stock movements. This study addresses this gap by conducting a comparative analysis of deep learning and hybrid models for stock movement prediction in the Indonesian banking sector. The evaluation based on RMSE and MAE reveals that the LSTM-CNN hybrid consistently outperforms other models, showcasing its versatility and accuracy across different data characteristics. Then, exploration through hyperparameter tuning demonstrates the criticality of parameter selection in optimizing model performance. These findings contribute to advancing predictive modeling in financial markets, offering valuable insights for investors, analysts, and policymakers. Further research in hyperparameter tuning and model optimization holds promise for enhancing accuracy and reliability in stock price prediction.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

References

M. Iyyappan, S. Ahmad, S. Jha, A. Alam, M. Yaseen and H. A. M. Abdeljaber, “A Novel AI-Based Stock Market Prediction Using Machine Learning Algorithm,” Scientific Programming, vol. 2022, 2022.

C. C. Emioma and S. O. Edeki, “Stock price prediction using machine learning on least-squares linear regression basis,” Journal of Physics: Conference Series, vol. 1734, no. 1, pp. 1-9, 2021.

A. Singh, P. Gupta and N. Thakur, “An empirical research and comprehensive analysis of

stock market prediction using machine learning and deep learning techniques,” IOP Conference Series: Materials Science and Engineering, vol. 1022, no. 1, pp. 1-12, 2021.

A. Subasi, F. Amir, K. Bagedo, A. Shams and A. Sarirete, “Stock Market Prediction Using

Machine Learning,” Procedia Computer Science, vol. 194, pp. 173–179, 2021.

H. Kabir, A. Sobur and R. Amin, “Stock Price Prediction Using The Machine Learning,” International Journal of Creative Research Thoughts (IJCRT), vol. 11, no. 7, pp. 946–950, 2023.

M. Pinelis and D. Ruppert, “ScienceDirect,” The Journal of Finance and Data Science, vol. 8, pp. 35–54, 2022.

M. M. Akhtar, A. S. Zamani, S. Khan, A. S. A. Shatat, S. Dilshad and F. Samdani, “Stock

market prediction based on statistical data using machine learning algorithms,” Journal of King Saud University - Science, vol. 34, no. 4, 2022.

M. Vijh, D. Chandola, V. A. Tikkiwal, and A. Kumar, “Stock Closing Price Prediction using

Machine Learning Techniques,” Procedia Computer Science, vol. 167, pp. 599–606, 2020.

P. Jaquart, S. K¨opke and C. Weinhardt, “Machine learning for cryptocurrency market prediction and trading,” The Journal of Finance and Data Science, vol. 8, pp. 331–352, 2022.

U. Singh, D. Vasa, L. R. Mitta, K. Saurabh, R. Vyas and O. Vyas, “Use of Heterogeneous

Data for Forecasting of Stock Market Movement using Social Media and Financial News Headlines,” ECTI-CIT Transactions, vol. 17, no. 04, pp. 488–500, 2023.

D. H. Fudholi, R. A. N. Nayoan and S. Rani, “Stock Prediction Based on Twitter Sentiment Extraction Using BiLSTM-Attention,” Indonesian Journal of Electrical Engineering and Informatics (IJEEI), vol. 10, no. 1, pp. 187–198, 2022.

K. R. Baskaran and B. Kaviya, “Stock Market Prediction Using Machine Learning and

Deep Learning Algorithms,”inSustainable Digital Technologies for Smart Cities Healthcare,

Communication, and Transportation, 1st Edition, Boca Raton, CRC press, 2023, pp. 127–138.

S. Albahli, A. Irtaza, T. Nazir, A. Mehmood, A. Alkhalifah and W. Albattah, “A Machine Learning Method for Prediction of Stock Market Using Real-Time Twitter Data,” Electron, vol. 11, no. 20, 2022.

A. Borr´e, L. O. Seman, E. Camponogara, S. F. Stefenon, V. C. Mariani, and L. dos S. Coelho, “Machine Fault Detection Using a Hybrid CNN-LSTM Attention-Based Model,” Sensors, vol. 23, no. 9, pp. 1–21, 2023.

A. Rayan et al., “Utilizing CNN-LSTM techniques for the enhancement of medical systems,” Alexandria Engineering Journal, vol. 72, pp. 323–338, 2023.

Y. A. Mohammed Alsumaidaee et al., “Detection of Corona Faults in Switchgear by Using 1D-CNN, LSTM, and 1D-CNN-LSTM Methods,” Sensors, vol. 23, no. 6, pp. 1–19, 2023.

Z. Alshingiti, R. Alaqel, J. Al-Muhtadi, Q. E. U. Haq, K. Saleem, and M. H. Faheem, “A Deep Learning-Based Phishing Detection System Using CNN, LSTM, and LSTM-CNN,” Electron, vol. 12, no. 1, pp. 1–18, 2023.

F. Aksan, Y. Li, and V. Suresh, “CNN-LSTM vs LSTM-CNN to Predict Power Flow Direction: A Case Study of The High-Voltage Submet of Northeast Germany,” Sensors, vol. 23, pp. 1–20, 2023.

Y. Mehta, A. Malhar, and R. Shankarmani, “Stock Price Prediction using Machine Learning and Sentiment Analysis,” in 2021 2nd International Conference for Emerging Technology (IN-CET), pp. 189–193, 2021.

M. Awad and S. Fraihat, “Recursive Feature Elimination with Cross-Validation with Decision Tree: Feature Selection Method for Machine Learning-Based Intrusion Detection Systems,” Journal of Sensor Actuator Networks, vol. 12, no. 5, 2023.

M. Bansal, A. Goyal and A. Choudhary, “Stock Market Prediction with High Accuracy using Machine Learning Techniques,” Procedia Computer Science, vol. 215, pp. 247–265, 2022.

S. Aslam, H. Herodotou, S. M. Mohsin, N. Javaid, N. Ashraf and S. Aslam, “A survey on

deep learning methods for power load and renewable energy forecasting in smart microgrids,” Renewable and Sustainable Energy Reviews, vol. 144, no. 110992, 2021.

D. Kumar, P. K. Sarangi, and R. Verma, “A systematic review of stock market prediction

using machine learning and statistical techniques,” Materials Today Proceedings, vol. 49,

pp. 3187–3191, 2020.