Use of Heterogeneous Data for Forecasting of Stock Market Movement Using Social Media and Financial News Headlines

Main Article Content

Abstract

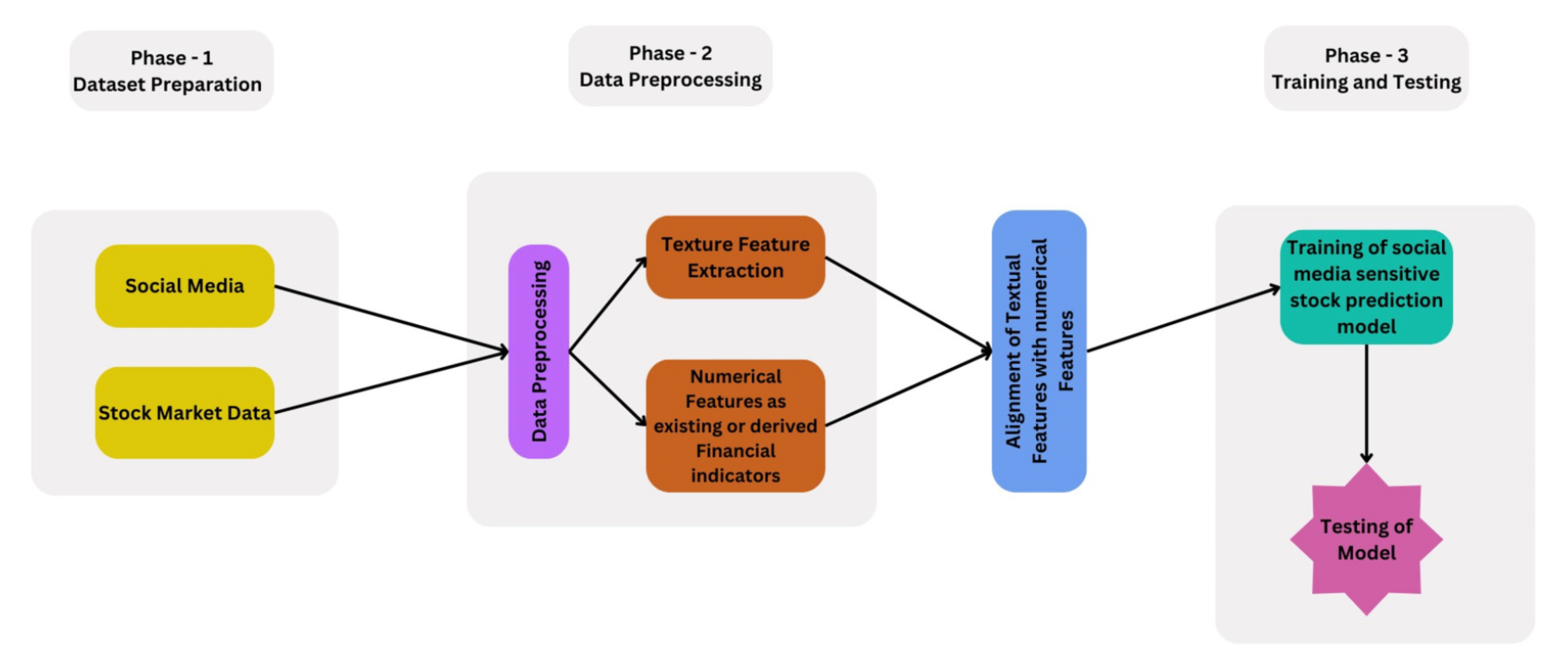

The stock market holds a significant role in shaping a nation's economic landscape and impacting the prosperity of businesses. It goes hand in hand with the country's development, closely mirroring market behaviour. While global and societal dynamics exert their influence, technological advancements stand as the primary driving force behind market trends. The fusion of social media and financial news headlines provides a valuable lens into the collective sentiment of the public. This study aims to craft an LSTM model for predicting stock volatility movements. This research delves into various facets of the stock market domain, introducing diverse inputs for comparison against the original market trends. These inputs comprise a rich tapestry of data, including information from social media networks and news headlines sourced from official publications. The goal is to gauge public sentiment as a potent factor for more precise predictions, diverging from the conventional transaction-based stock price forecasts. The outcomes have been promising. By leveraging public sentiment analysis, overall errors have been reduced, with a 43.86% drop in Mean Absolute Error (MAE) and an impressive 50.93% decrease in Root Mean Square Error (RMSE) compared to without sentimental analysis. These results signal a step forward in enhancing the accuracy of stock market predictions.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

References

U. Singh, S. Tamrakar, K. Saurabh, R. Vyas and O. P. Vyas, “Hyperparameter Tuning for LSTM and ARIMA Time Series Model: A Comparative Study,” 2023 IEEE 4th Annual Flagship India Council International Subsections Conference (INDISCON), Mysore, India, pp. 1-6, 2023.

K. Saurabh, S. Sood, P. A. Kumar, U. Singh, R. Vyas, O. P. Vyas, and R. Khondoker, “LBDMIDS: LSTM Based Deep Learning Model for Intrusion Detection Systems for IoT Networks,” 2022 IEEE World AI IoT Congress (AIIoT), Seattle, WA, USA, pp. 753-759, 2022.

K. Saurabh, A. Singh, U. Singh, O. P. Vyas and R. Khondoker, “GANIBOT: A Network Flow Based Semi Supervised Generative Adversarial Networks Model for IoT Botnets Detection,” 2022 IEEE International Conference on Omnilayer Intelligent Systems (COINS), Barcelona, Spain, pp. 1-5, 2022.

U. Singh, T. Musale, R. Vyas, and O. Vyas, “Agricultural plantation classification using transfer learning approach based on cnn,” arXiv preprint arXiv:2206.09420, 2022.

K. Saurabh, T. Kumar, U. Singh, O. P. Vyas and R. Khondoker, “NFDLM: A Lightweight Network Flow based Deep Learning Model for DDoS Attack Detection in IoT Domains,” 2022 IEEE World AI IoT Congress (AIIoT), Seattle, WA, USA, pp. 736-742, 2022.

U. Singh, K. Saurabh, N. Trehan, R. Vyas and O. P. Vyas, “Terrain Classification using Transfer Learning on Hyperspectral Images: A Comparative study,” 2022 IEEE 19th India Council International Conference (INDICON), Kochi, India, pp. 1-6, 2022.

B. Krollner, B. J. Vanstone, and G. R. Finnie, “Financial time series forecasting with machine learning techniques: a survey,” in The European Symposium on Artificial Neural Networks, 2010. [Online]. Available: https://api.semanticscholar.org/CorpusID:14947431

P. S. Rao, K. Srinivas, and A. K. Mohan, “A survey on stock market prediction using machine learning techniques,” in ICDSMLA 2019, A. Kumar, M. Paprzycki, and V. K. Gunjan, Eds. Singapore: Springer Singapore, pp. 923–931, 2020.

V. Derbentsev, A. V. Matviychuk, N. Datsenko, V. Bezkorovainyi, and A. Azaryan, “Machine learning approaches for financial time series forecasting,” in M3E2-MLPEED, 2020. [Online]. Available: https://api.semanticscholar.org/CorpusID:229356996

A. Dingli and K. S. Fournier, “Financial time series forecasting – a deep learning approach,” International Journal of Machine Learning and Computing, vol. 7, pp. 118–122, 2017. [Online]. Available: https://api.semanticscholar.org/CorpusID:159007072

J. Cao, Z. Li, and J. Li, “Financial time series forecasting model based on ceemdan and lstm,” Physica A: Statistical mechanics and its applications, vol. 519, pp. 127–139, 2019.

C. M. Liapis, A. Karanikola, and S. Kotsiantis, “A multi-method survey on the use of sentiment analysis in multivariate financial time series forecasting,” Entropy, vol. 23, no. 12, 2021. [Online]. Available: https://www.mdpi.com/1099-4300/23/12/1603

Z. Drus and H. Khalid, “Sentiment analysis in social media and its application: Systematic literature review,” Procedia Comput. Sci., vol. 161, no. C, pp. 707–714, jan 2019. [Online]. Available: https://doi.org/10.1016/j.procs.2019.11.174

S. Mohan, S. Mullapudi, S. Sammeta, P. Vijayvergia and D. C. Anastasiu, “Stock Price Prediction Using News Sentiment Analysis,” 2019 IEEE Fifth International Conference on Big Data Computing Service and Applications (BigDataService), Newark, CA, USA, pp. 205-208, 2019.

R. Gupta and M. Chen, “Sentiment Analysis for Stock Price Prediction,” 2020 IEEE Conference on Multimedia Information Processing and Retrieval (MIPR), Shenzhen, China, pp. 213-218, 2020.