Analyzing In uential Factors on the Recovery Time of Non-Performing Loans: A Time Series and Machine Learning Approach

Main Article Content

Abstract

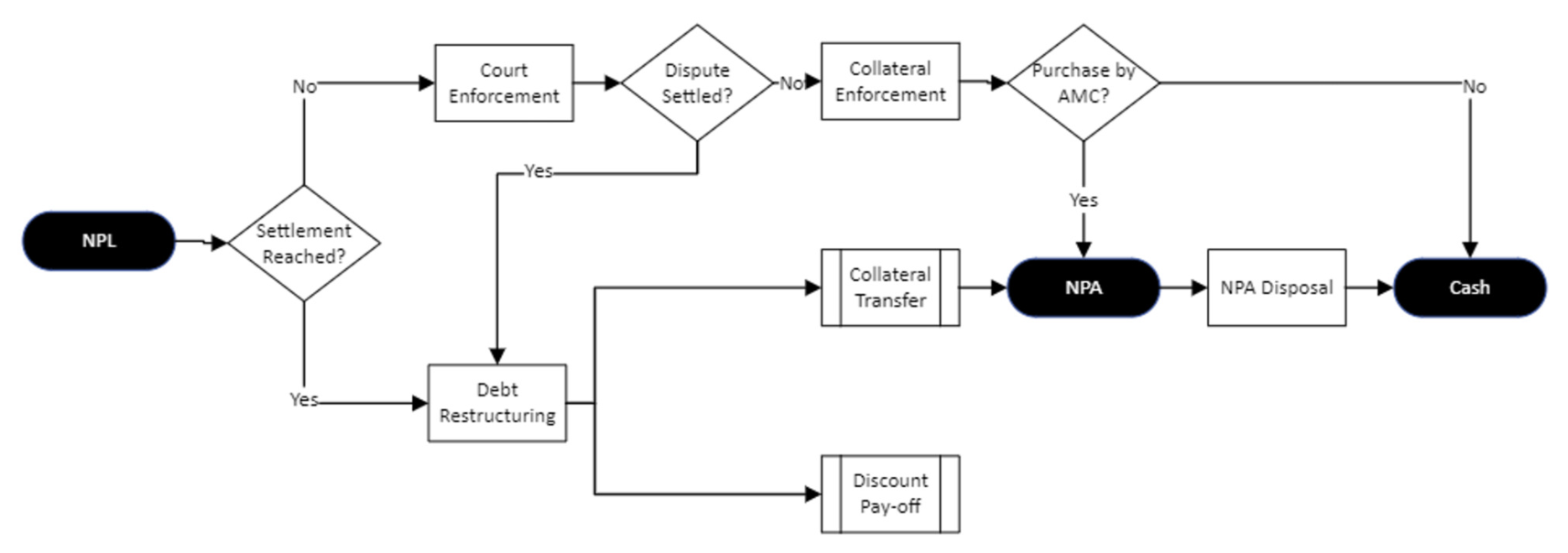

Non-performing Loans (NPLs) are critical factors that impede economic growth. Effcient management systems are required to expedite the resolution process for borrowers. However, managing NPLs remains challenging due to their complex behavior, which is difficult to understand. Consequently, this paper aims to enhance the understanding of borrower behavior and characteristics that affect recovery time, thereby enabling more effective loan recovery strategies. In this paper, we propose a combination of time-series clustering using Dynamic Time Warping (DTW) and random forest classification to analyze the impact of various features on the clustering results of loan recovery time based on collection patterns in the context of 2,839 loans. Our findings reveal that borrowers with lower outstanding principal balances, collateral appraisal values, and legal balance-to-appraisal values generally exhibit shorter recovery times. Additionally, the collateral subtype and the underwriting appraisal value of the collateral assets emerge as the most representative features of the clusters.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

References

S. Aghabozorgi, A. S. Shirkhorshidi and T. Y. Wah, “Time-series clustering – A decade review,” Information Systems, vol. 53, pp. 16-38, 2015.

A. Bellotti, D. Brigo, P. Gambetti and F. Vrins, “Forecasting Recovery Rates on Non-Performing Loans with Machine Learning,” International Journal of Forecasting, vol. 37, no. 1, pp.428-444, 2021.

N. Bhatt and S.-Y. Tang, “Determinants of Repayment in Microcredit: Evidence from Programs in the United States,” International Journal of Urban and Regional Research, vol. 26, no. 2, pp. 360-376, 2002.

L. Breiman, “Random Forests,” Machine Learning, vol. 45, pp. 5-32, 2001.

C. Cassisi, P. Montalto, M. Aliotta, A. Cannata and A. Pulvirenti, “Similarity measures and dimensionality reduction technique for time series data mining,” Advances in Data Mining Knowledge Discovery and Applications., InTech, pp. 70-96, Sep. 2012.

D. Cheng and P. Cirillo, “A Reinforced Urn Process Modeling of Recovery Rates and Recovery Times,” Journal of Banking & Finance, vol. 96, pp. 1-17, Nov. 2018.

Ciavoliello, L. G., et al. (2016). What’s the value of NPLs., Banca Di Italia.

J. Fell, M. Grodzicki, R. Martin and E. O’Brien, “A Role for Systemic Asset Management Companies in Solving Europe’s Non-Performing Loan Problems,” European Economy Banks, pp. 71-85, 2017.

F. Iglesias and W. Kastner, “Analysis of Similarity Measures in Times Series Clustering for the Discovery of Building Energy Patterns,” Energies, vol. 6, no. 2, pp. 579–597, Jan. 2013.

A. K. Jain and R. C. Dubes, Algorithms for Clustering Data, New Jersey, Prentice-Hall, 1948, pp. 96-97.

R. P. Kumar and P. Nagabhushan, “Time Series as a Point – A Novel Approach for Time Series Cluster Visualization,” International Conference on Data Mining, 2006.

Y. Lei et al., “Ground truth bias in external cluster validity indices,” Pattern recognition, vol. 65, pp. 58-70, 2017.

M. Leng, X. Lai, G. Tan and X. Xu, “Time series representation for anomaly detection,” 2009 2nd IEEE International Conference on Computer Science and Information Technology, Beijing, pp. 628-632, 2009.

A. Liaw and M. Wiener, “Classification and Regression by RandomForest,” R News, vol. 2, no. 3, pp. 18-22, Dec. 2002.

R. Ma and R. Angryk, “Distance and Density Clustering for Time Series Data,” 2017 IEEE International Conference on Data Mining Workshops (ICDMW), New Orleans, LA, USA, pp. 25-32, 2017.

F. Pauer and S. Pichler, “Sell or Hold? On the Value of Non-Performing Loans and Mandatory Write-Off Rules,” SSRN, 2021.

J. Paxton, D. Graham and C. Thraen, “Modeling Group Loan Repayment Behavior: New Insights from Burkina Faso,” Economic Development and Cultural Change, vol. 48, no. 3, pp. 639-655, 2000.

S. J. Wilson, “Data representation for time series data mining: time domain approaches,” WIREs Computational Statistics, vol. 9: e1392, 2017.

A. Sfetsos and C. Siriopoulos, “Time series forecasting with a hybrid clustering scheme and pattern recognition,” in IEEE Transactions on Systems, Man, and Cybernetics Part A: Systems and Humans, vol. 34, no. 3, pp. 399-405, May 2004.

F. Shen and N. Luo, “Investment pattern clustering based on online P2P lending platform,” 2016 IEEE/ACIS 15th International Conference on Computer and Information Science (ICIS), Okayama, Japan, pp. 1-6, 2016.

Shutaywi, M.; Kachouie, N.N.ette Analysis for Performancetion in Machine Learning with Applications to Clustering. Entropy 2021, 23, 759. https://doi.org/10.3390/e2306075

A. Stetco, X. -j. Zeng and J. Keane, “Fuzzy Cluster Analysis of Financial Time Series and Their Volatility Assessment,” 2013 IEEE International Conference on Systems, Man, and Cybernetics, Manchester, UK, pp. 91-96, 2013.

H. Ye and A. Bellotti, “Modelling Recovery Rates for Non-Performing Loans,” Risks, vol. 7, no. 1, p. 19, Feb. 2019.