Estimation of Loan Repayment Events in Microfinance Bank Using L1 - Lasso Penalized Cox Proportional Hazards Approach

Keywords:

Bank Credit, L1 - Lasso, Cox Model, Penalization, Predictive VariablesAbstract

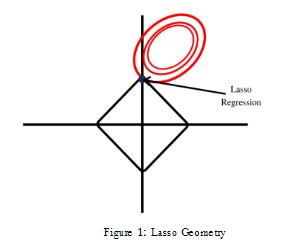

This study applied L1- Lasso estimation for Cox proportional hazards model to select variables that are relevant to credit repayment rates of loan by bank customers and to build a predictive model. A dataset was used to predict credit repayment time by the customers using L1- Lasso and Cox proportional hazards procedures in order to find the variables that are related to time to credit repayment rates, for building a sparse model and for predicting the survival of credit repayment rates by customer in the future. Records of 186 customers of a Microfinance bank is used. The L1 - Lasso penalized Cox proportional hazards approach was able to identify the most predictive variables for repayment rates of loan. The findings of this study have shown that, the repayment rates of loan is significantly related with marital status, type of collateral and residence, whereas the variables age and occupation are less significantly related with the survival of loan repayment rates of customers. Finally, the variables selected by the model can be used in granting loan to customers in Microfinance banking. R Programming Language was used for the analysis.

References

Abhinaya, D., Patil, S. G., Dheebakaran, G., Djanaguiraman, M., & Arockia, S. R. (2021). Use of statistical models in predicting groundnut yield in relation to weather parameters.

Apostolik, R., Donohue, C., & Went, P. (2009). Foundations of banking risk: an overview of banking, banking risks, and risk-based banking regulation. John Wiley & Sons. (pp. 16-22)

Cox, D. R. (1972). Regression models and life‐tables.Journal of the Royal Statistical Society: Series B (Methodological),34(2), 187-202.

Ekman, A. (2017). Variable selection for the Cox proportional hazards model: A simulation study comparing the stepwise, lasso and bootstrap approach[Master thesis]. UMEÅ University University.

Fejza, D., Nace, D., & Kulla, O. (2022). The Credit Risk Problem-A Developing Country Case Study.Risks,10(8), 146.

Gunduz, V. (2020). Risk Management in Banking Sector. Bahç eşehir Cyprus University Banking and Finance. Publisher: Artikel Akademie. (pp. 121-135).

Hastie, T., Tibshirani, R., & Wainwright, M. (2015). Statistical learning with sparsity. Monographs on statistics and applied probability, 143(143), 8.

Kleinbaum, D. G., & Mitchel, S. (2005). Survival Analysis: A Self-Learning Text (3rded.). Springer. (pp. 98-164).

Li, H., Campbell, D., & Erdem, S. (2022). Measuring time preferences using stated credit repayment choices.Journal of Quantitative Economics,20(1), 43-67.

Mungasi, S., Odhiambo, C. (2019). Comparison of Survival Analysis Approaches to Credit Risks. .American Journal of Theoretical and Applied Statistics, 8(2), 39-46.

Nawai, N., & Shariff, M. N. M. (2013). Loan Repayment Problems in Microfinance Programs that use Individual Lending Approach: A Qualitative Analysis. Journal of Transformative Entrepreneurship, 1(2), 93-99.

Ogunleye, G. A. (2010).Perspectives on the Nigerian financial safety-net. Nigeria Deposit Insurance Corporation.

Okpara, G. C. (2009). A synthesis of the critical factors affecting performance of the Nigerian banking system.European Journal of Economics, Finance and Administrative Sciences,17(17), 34-44.

Sangeetha, S., & Chitra, K. (2021). Solvency and Survival of Microfinance Institutions: An Indian Scenario-Policy Implications to Improve Endurance.Indian Journal of Finance and Banking,5(2), 130-140.

Thackham, M. (2021). Survival Analysis: Applications to Credit Risk Default Modelling[Doctoral thesis]. Macquarie University.

Thevaraja, M., Rahman, A., & Gabirial, M. (2019, April). Recent developments in data science: Comparing linear, ridge and lasso regressions techniques using wine data. InProceedings of the international conference on digital image & signal processing(pp. 1-6).

Tibshirani, R. (1996). Regression shrinkage and selection via the lasso.Journal of the Royal Statistical Society Series B: Statistical Methodology,58(1), 267-288.

Twin, A. (2020). The Investopedia Express Padcast. Retrieved 2020, from http:/www.investopedia.com/terms/b/bank-redit.asp

Xia, Y., He, L., Li, Y., Fu, Y., & Xu, Y. (2021). A dynamic credit scoring model based on survival gradient boosting decision tree approach.Technological and Economic Development of Economy,27(1), 96-119.

Zhang, D. F., Bhandari, B., & Black, D. (2020). Covariate Selection for MortgageDefault. Anareview approach and discussion.Ingenieŕıae Investigación, 40(2), 50-71.

Downloads

Published

License

Copyright (c) 2024 Journal of Applied Science and Emerging Technology

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.